Award-winning PDF software

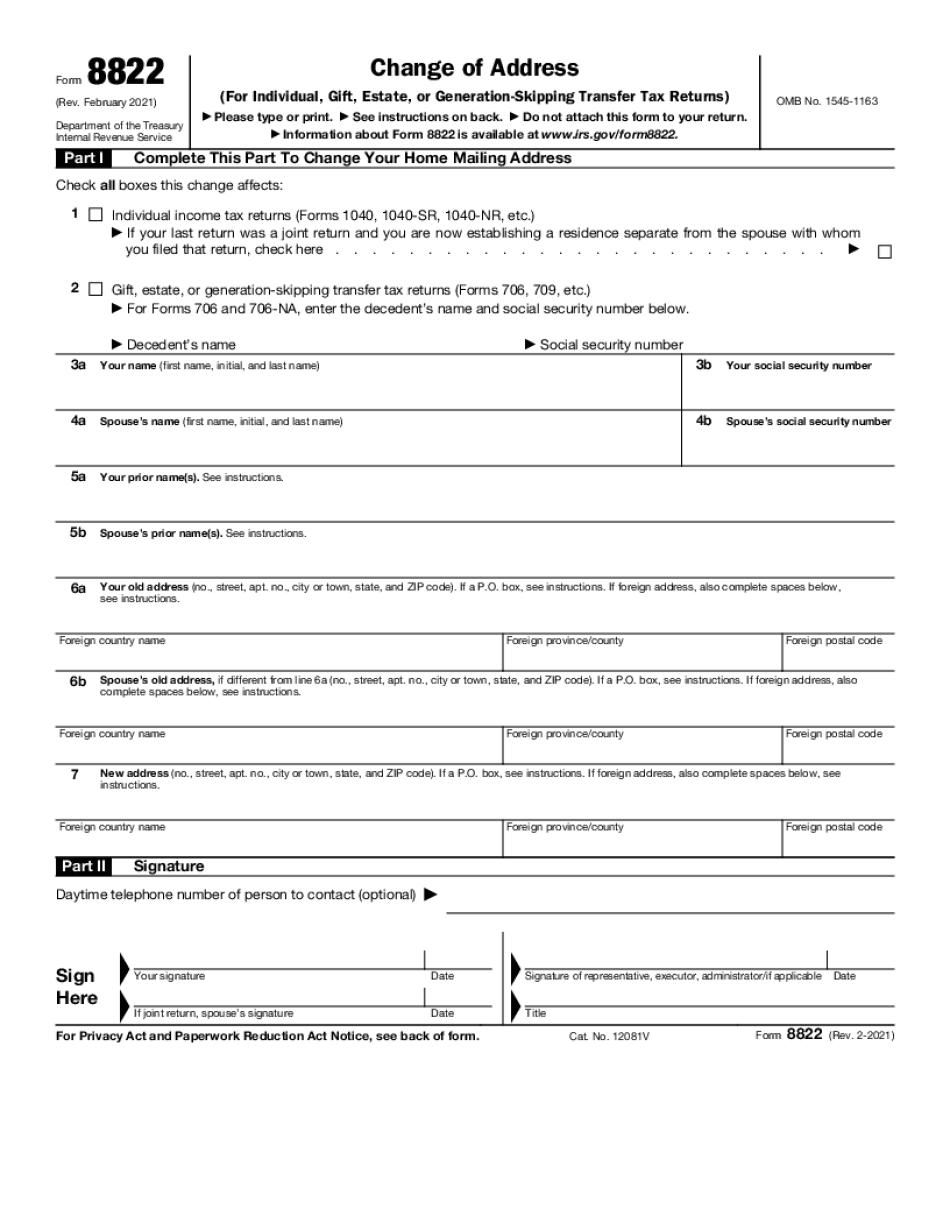

Spokane Valley Washington Form 8822: What You Should Know

Ask for help. What To Do For A Tax Tip? Don't forget to call us for help. In Spokane Valley, we have a team of tax lawyers, tax accountants and tax experts, whose job it is to help you keep track of your tax bill. We specialize in the following areas: Tax preparation Tax reporting Tax education Tax debt management Call us for help! Shelton Hansen, CROSSING CORPORATION What to watch out for when making your tax payment: Tax preparers (tax preparers) must be certified as a tax preparer, and they must meet these requirements to operate the business: (A) a total of at least five (5) years as a tax preparer as a member of a tax professional organization; (B) meet the tax professional practice standard for tax preparation of three years and receive two (2) years of coursework from an accredited tax professional society for tax preparation; (C) meet the minimum certification requirements for a Certified Taxpayer Advocate. A certified taxpayer advocate (CTA) must provide support during a taxpayer's tax return under the guidance of a qualified tax return preparer. A qualified tax return preparer must be an individual or non-profit organization with an approved tax return preparation certification from the state or local authority where the taxpayer's tax returns are filed. (See: State Approved Tax Return Preparers — Washington State's Tax Return Preparation Certification Process) A tax return preparation certification (tax return preparation certification) from one of the following tax professional organizations: Professional Tax Institute (PTI), National Taxpayer Advocate Association (NCAA), IRS, or the Professional Code Development Group (CDG). A qualified tax return preparer must provide support during their tax return under the guidance of a qualifying tax return preparer. (See: Oregon Tax Information Center) A qualified tax return preparer must be an individual or non-profit organization with an approved tax return preparation certification (certification) from a nationally-recognized tax return preparation certification provider, such as CDG, or one of the tax professional organizations listed above, to qualify as a tax return preparer.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Spokane Valley Washington Form 8822, keep away from glitches and furnish it inside a timely method:

How to complete a Spokane Valley Washington Form 8822?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Spokane Valley Washington Form 8822 aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Spokane Valley Washington Form 8822 from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.