Award-winning PDF software

Modesto California Form 8822: What You Should Know

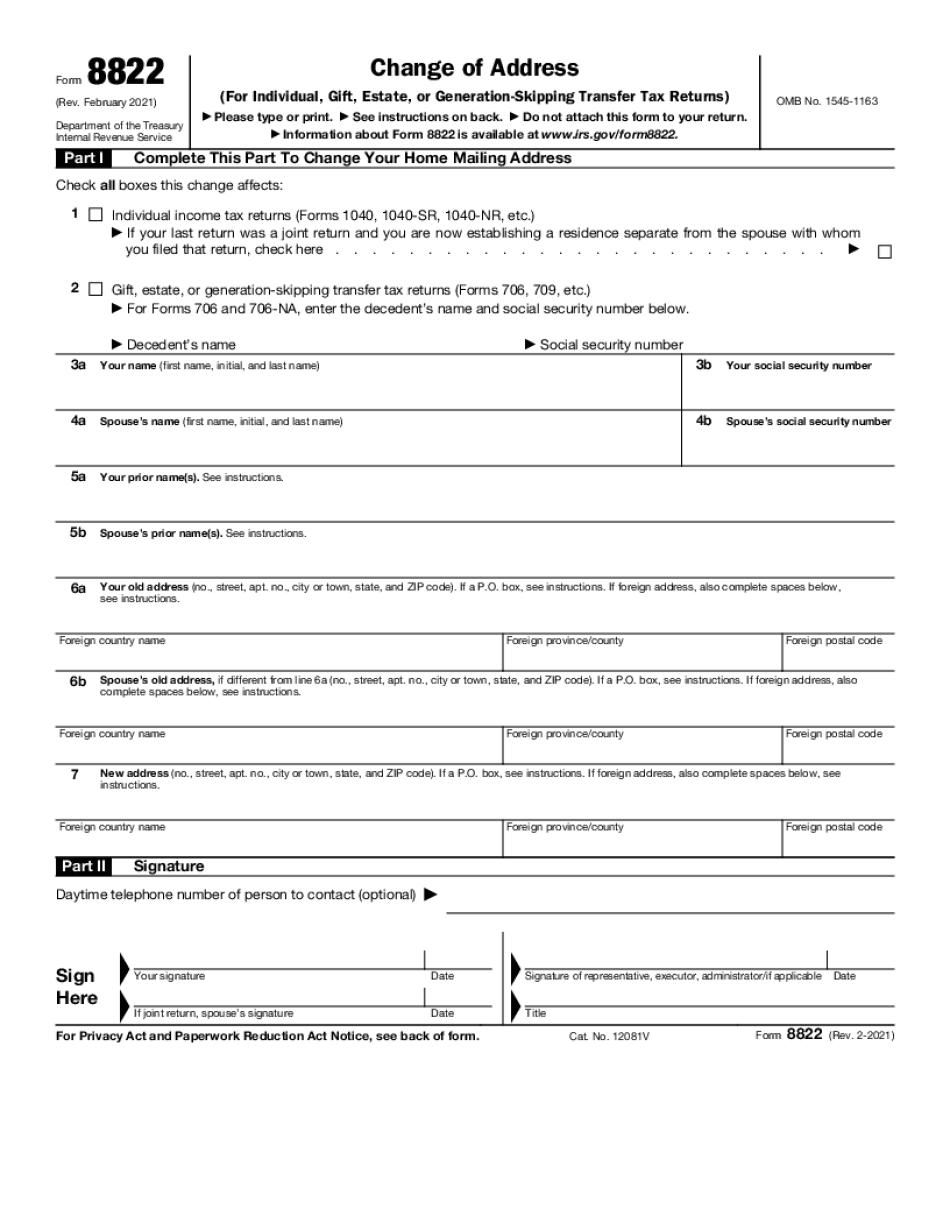

The Tax Organizer is also a useful tool to print out. IRS Publications — Internal Revenue Bulletin: Revenue Procedure 2003-10, Income Tax Requirements for Individuals.pdf IRS Publication 15-B: Changes to Schedule D The new 2003-06 Tax Year Schedule D has been updated (November 1, 2011.) Schedule D changed as follows: Effective as of January 1, 2006. The table for “Other Income” has been deleted and replaced by the following: “Deductions not itemized that do not exceed 20% of gross income and do not result in a negative deduction. Also deleted is the “Interest on capital advances”. Effective as of October 1, 2006. The table for “Total Income” has been deleted and replaced by the following: “Deductions itemized that exceed 20 percent of gross income and do not result in a negative deduction. Also deleted are the following items: Interest on capital advances. Effective as of November 1, 2006. The table for “Deductions” has been deleted and replaced with the following: “Amounts of self-employment income that are described in section 1161(a)(13). Also deleted are the self-employment income items: (1) Additional wages reported on line 12 of Form 8947. (2) Additional self-employment income reported with Form 8947 in box 2F on line 12 of the return.” New Schedule D: 2003-06 The IRS published a new schedule D, the 2003-06 IRS schedule D. Schedule D is a table of items where the taxpayer enters in their tax return the information. This information is entered and recorded in their tax return, which is filed for payment to the IRS. This is done in order to reduce the paperwork on tax returns. Schedule D includes the standard tax items (other than income taxes) in order to reduce the tax payment to the IRS, as well as the items that the taxpayer cannot deduct. This item is a change of address (Form 8822) to the address shown in section III of Form 8822.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Modesto California Form 8822, keep away from glitches and furnish it inside a timely method:

How to complete a Modesto California Form 8822?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Modesto California Form 8822 aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Modesto California Form 8822 from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.