Award-winning PDF software

Aurora Colorado online Form 8822: What You Should Know

Taxation— City of Aurora, Colorado The City of Aurora is required by statute to collect all city, county, and school district taxes regardless of whether the taxpayer or the taxpayer's agent filed an information return and regardless of whether the taxpayer makes any request for payment. The statute provides the following requirements and conditions. Sales tax collection — city of ark (CO) As a requirement of the Colorado law enacted Feb. 24, 1992, the city must collect from each person who obtains property in the city 100.00 in taxes within 30 days of the transfer of ownership. See Colo. Rev. Stat. § 36-12-111. Sales tax collection— city of ark (CO) Colorado's sales tax is the highest in the union. To help bring our taxes closer to those of neighboring states, the city has provided a sales tax exemption for those who buy property only within our city boundaries, for example by purchasing a home or a condominium or a house in the City of Aurora on the same lot as the residence, or a house purchased from and sold on the same street as the residence. See Colo. Rev. Stat. § 36-12-111. As a requirement of the Colorado law enacted Mar. 6, 2002, Colorado requires each homeowner (landlord) to deduct real expenses related to the upkeep and/or repair of properties acquired, purchased, rented, or leased on or after Aug. 1, 2025 (referred to as “pre-2002 properties”) as part of the deduction. See Colo. Rev. Stat. § 8-1-109(1)(a)(C). If I buy my home on the same street as my residence and the transfer of ownership occurs prior to July 1, 2006, but my property is subject to sales tax and I bought the home before the new law took effect, can I avoid paying the taxes because I got the property before the change in tax law? Yes. As a condition of Section 36-12-111(2) of the Property Tax Code, the city is required to collect the tax when a taxpayer obtains property in the city, but the transfer of ownership occurs before July 1, 2006. See Colo. Rev. Stat. § 36-12-111(2)(c). See the following example for a hypothetical transfer of ownership.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Aurora Colorado online Form 8822, keep away from glitches and furnish it inside a timely method:

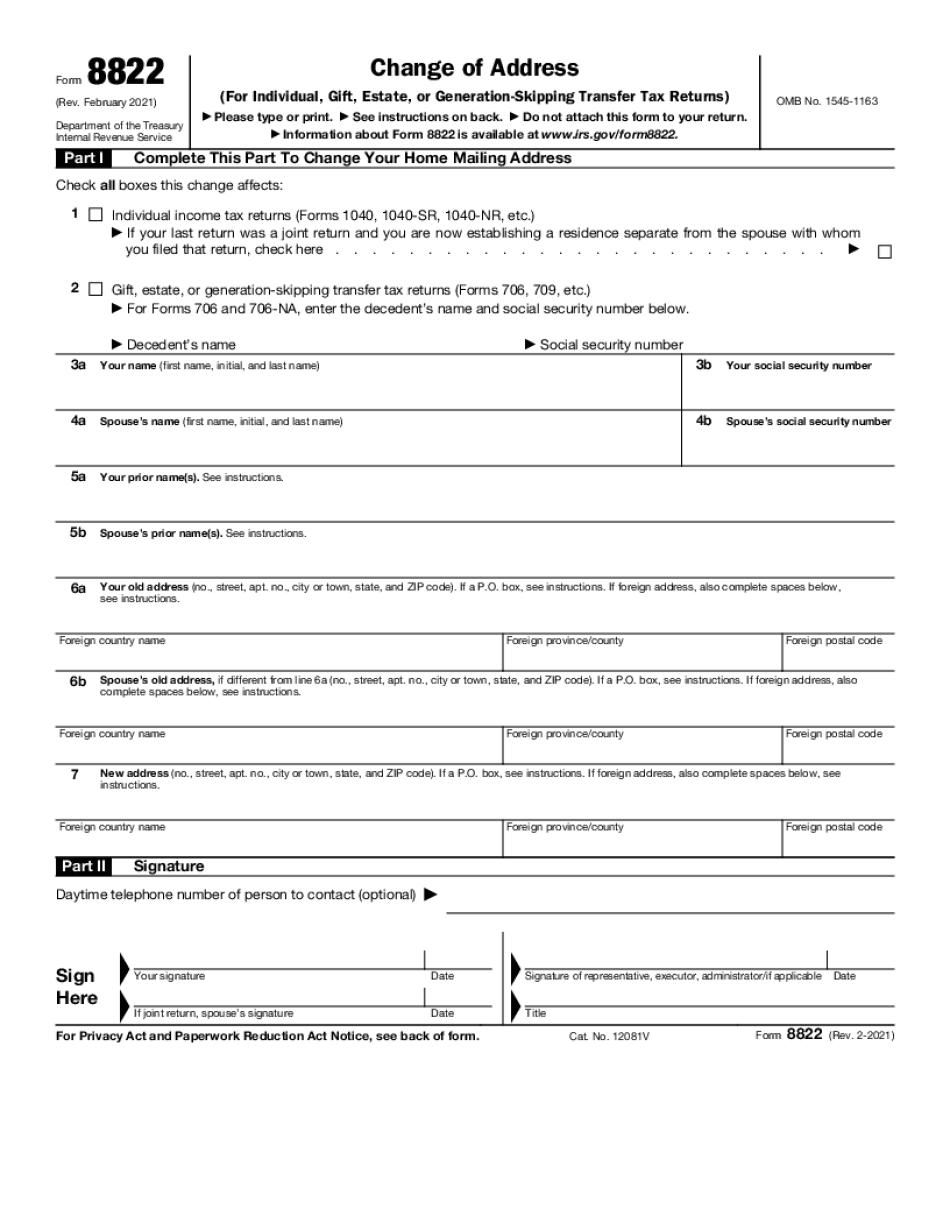

How to complete a Aurora Colorado online Form 8822?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Aurora Colorado online Form 8822 aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Aurora Colorado online Form 8822 from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.