Hi, I'm James for Attacks.com. If you change your name after a recent marriage, divorce, or for any other reason, you'll need to register the change with the Social Security Administration before filing your tax return. Names that don't match can cause problems during the return processing, potentially delaying your refund. To update your records, you should use Form SS-5, which is the application for a Social Security Card. You can obtain this form from the Social Security Administration's website at ssa.gov or from your local Social Security office. Whether you file Form SS-5 at the office or via mail, you must provide documentation of your legal name change, such as an original or certified copy of your marriage certificate. For more information, please visit Attacks.com.

Award-winning PDF software

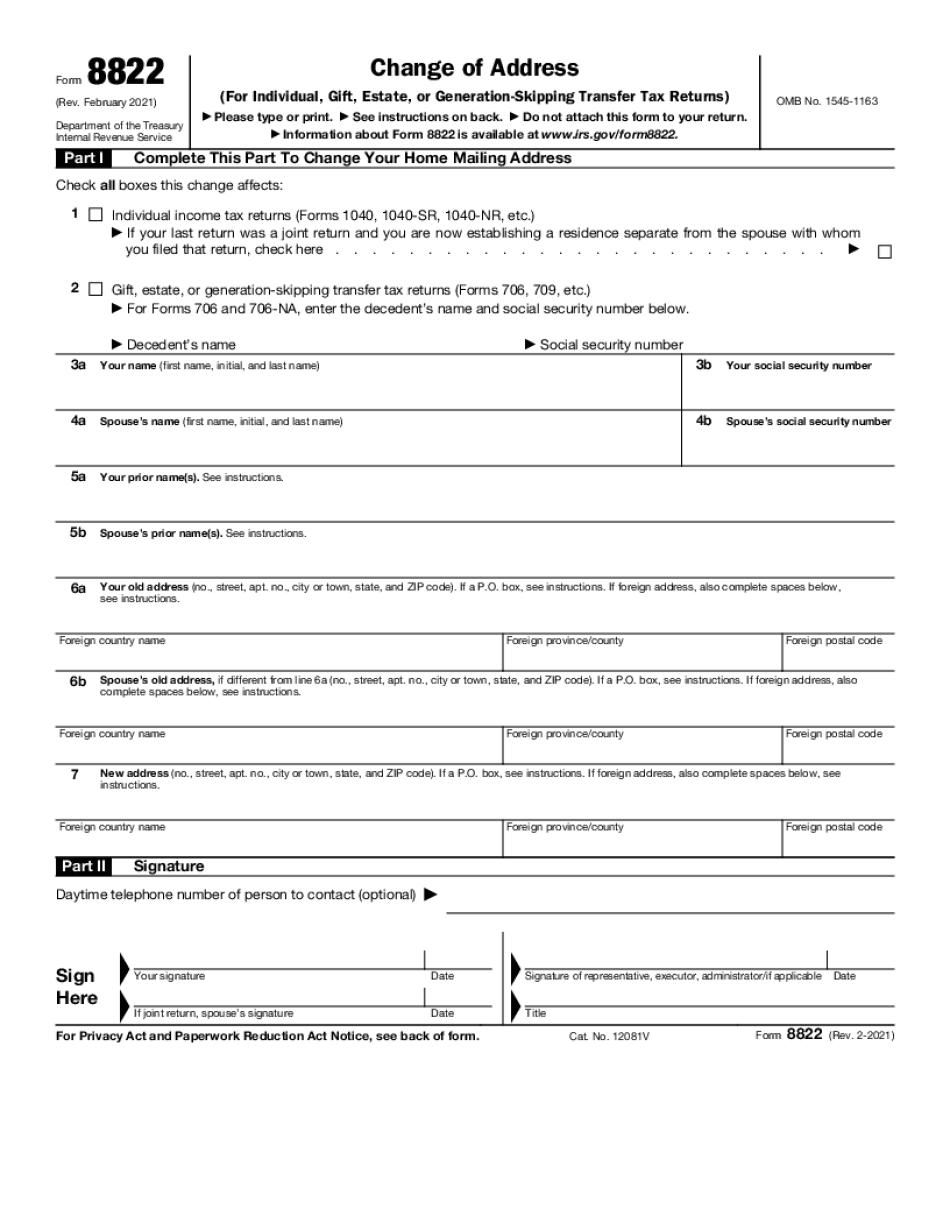

How to fill out a 8822 Form: What You Should Know

IRS Forms 8822 — Change and Mailing Address — YouTube July 26, 2025 — How to fill out and mail a form 8822 for business change of address. The IRS allows you to update your Form 8822, so you can include your new business address in your taxes. The Form 8822 can be filed by the due date. For more information and videos on how to fill out Form 8822 : The IRS Forms 8822 — Change and Mailing Address — YouTube Form 8822 — Change of Address: Tips, Tricks and Advice — YouTube Oct 28, 2025 — How to fill out a change of address form 8822. For more information, go to IRS Form 8822. Change of address can be a life-changing event, and you must get it just right. Here's our help. How to fill out IRS Form 8822 (Change of Address) — YouTube About IRS Form 8822 and Change of Address Form 8822 requires only basic information, including: Your Name and Social Security Number Your Previous Address Your New Address Your Prior Names Your Prior and New Social Security Numbers Your Prior and New Address for Federal Tax Purposes Your Previous and New Business Filing Address and Mailing Address Your Previous and New City and Zip Code Your Prior and New Street Name and the City and Zip Code of Your New Address Your State and Zip Code Your Age Prior to Tax Day Your Employer's Name Your Taxpayer Status Employer is a federal, state, or local government agency, or other specified person (such as a partner, family member, etc.) Your Employer's Employer Identification Number How to fill out IRS Form 1040 Oct 28, 2025 — How to fill out IRS Form 1040. You might be able to complete IRS Form 1040 without filling out and mailing any of these forms if the IRS allows you to amend (change) your tax return when you are subject to tax. For more information on IRS Form 1040, go to IRS Form 1040. How to fill out IRS Form 1040 (Updated) — YouTube For more information, go to IRS Form 1040 Taxpayer ID Number (TIN) and Social Security Number. When do I use Form 1040? If you want to send your Form 1040 by email, you'll need to fill out IRS Form 1040A, Application for Advance Reimbursement for Claims Under Itemized Deduction. This is available on IRS website.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 8822, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 8822 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 8822 By using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 8822 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing How to fill out a 8822 Form